Launch Report Executive Summary

Launch Report Executive Summary

Lium research has initiated coverage of the grid-scale energy storage market and introduced proprietary datasets focusing on both macro level battery storage projections / economics and project level details. Here are the key takeaways from the launch report.

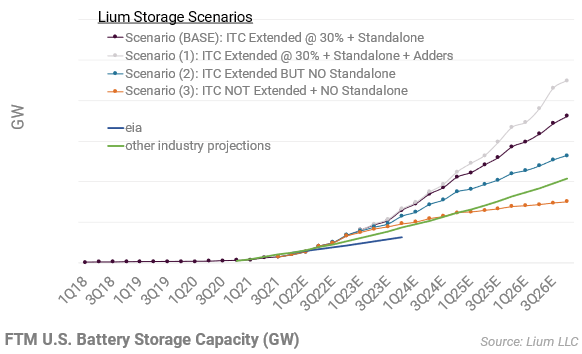

Underappreciated Growth. While battery storage participants are very aware of the growth potential in U.S. grid scale battery storage, we think the scale of this growth is still understated. The most recent example is an EIA report that suggests the U.S. battery storage market will only grow to 15 GW by 2024, less than half of what we think will actually happen.

450 Projects In The Works. To better gauge the battery storage potential, we have put eyes on over 1,000 U.S. battery storage projects that are in various stages from prospect to late-stage development. From here, we have identified roughly 450 projects (45 GW) that are in late stage development (high likelihood of being completed by 2025), 300 of which are not included in datasets such as the EIA, but confirmed through our sources on the ground, discussions with developers, satellite imagery etc.

Why It Matters. If the battery storage market plays out like we think it could, it literally changes the calculus for the energy transition. One example is Texas, where as much as 15% of peak summer electricity hours could be coming from batteries by 2025 (vs 0% in 2021). In total, we are projecting the U.S. battery storage market be almost 60 GW by 2025 (35% growth per year), significantly above most other forecasts.

Who Cares? Costs / Inflation Killing Demand. While higher costs have reduced battery storage demand, they have yet to kill it. In fact, storage applications, construction pipeline, and backlog have all continued to grow over the last 3-6 months despite supply chain bottlenecks and a double digit increase in battery cell costs. Also offsetting higher installation costs, wholesale electricity prices are also climbing, up 20-30% already in 2022.

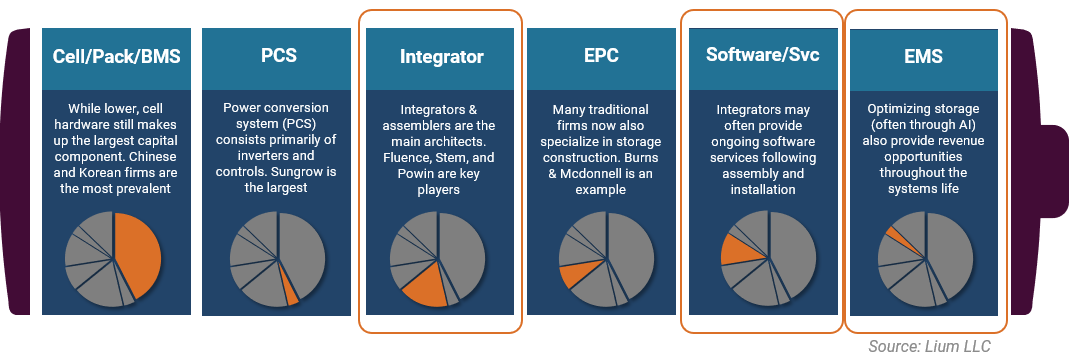

Investor Focused. Key investor themes / takeaways from the launch include identification of the best growth niches (integrators, EPC, battery manufacturers, Texas), areas to avoid (digital EMS, California), relevant public/private players, market potential & timing, policy considerations, and basic technology trends. While positive on the battery storage industry, we think the investment case is much more challenging (despite our above consensus industry growth projections), given that equity values already reflect exponential growth and challenging margins in a very competitive landscape. For public company investors, Fluence (FLNC) has the most direct leverage to grid scale battery storage while a basket of companies like Stem Inc (STEM), Freyr (FREY), and EOS Energy (EOSE) also give significant exposure. For private company investors, comfort with the macro themes (30-40% annual growth, New York / Texas surprise), and datasets around relevant players, development timing, project specifics, battery technology, and policy trends are key takeaways.

Where Could Our Above-Market Forecast Go Wrong? If an extension to the renewables investment tax credit (ITC) and a standalone component for battery storage does not make it into legislation over the next 12-18 months, our projections for 2023-2025 will likely be materially lower than our base case. As we show in our ‘no-ITC, no-standalone’ scenario on slide 34, battery storage capacity would likely stay below 30 GW through 2025 and only growing by 5% per year (vs our base case of 35% per year). Other ways our industry projections could be too high include further lithium price surges, no easing in supply bottlenecks, cost overruns, stalled wholesale electricity prices, and waning investor appetite.