Why It Matters: California is the largest state for residential solar installations, but investor owned utilities there proposed a net metering (NEM) scheme change in March 2021 that could greatly reduce the size of the residential solar market in California.

Key Takeaways

- With three of the largest California utilities proposing material changes to net metering last week (mid-March 2021) and the California Public Utilities Commission (CPUC) expected to update NEM rules near year-end 2021 (change will be effective 2022), we have taken a deeper dive into relevant data surrounding the issue.

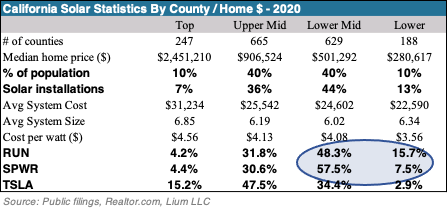

- In our opinion, some of the changes in this utilities proposal have a much higher chance of being approved, compared to prior attempts, as changes squarely focus on inequality, where data shows 70% of African Americans and 60% of Hispanics do not own homes (these groups currently carry an outsized % of grid costs from which solar homeowners benefit). Furthermore, the proposal attempts to shift benefits to lower income homeowners, where our data shows solar penetration is already strong and can get stronger, a win for both sides.

- If this proposal is ultimately approved, it adds net risk to our aggressive California solar growth assumptions (10-20% per year) and U.S. solar penetration assumptions (15% of homes by 2030).

- RUN, ENPH, and SEDG are most exposed to the California residential solar market (30-40% of US residential activity).

Home Solar Is For Everyone…

To better understand solar demographics, we have cross-referenced California solar installation data with home values, finding that areas with lower income homes are actually installing MORE solar per capita. In fact, last year 60% of California solar installations were in areas where homes prices averaged less than $500k (compared to only 50% of population in these areas), while 13% of solar installations were in areas where home prices averaged less than 300k (compared to only 10% of population). We also found RUN to have the highest relative exposure to lower middle and lower income households while TSLA most often served the higher middle and upper incomes.

To better understand solar demographics, we have cross-referenced California solar installation data with home values, finding that areas with lower income homes are actually installing MORE solar per capita. In fact, last year 60% of California solar installations were in areas where homes prices averaged less than $500k (compared to only 50% of population in these areas), while 13% of solar installations were in areas where home prices averaged less than 300k (compared to only 10% of population). We also found RUN to have the highest relative exposure to lower middle and lower income households while TSLA most often served the higher middle and upper incomes.

…As Long As You Own A House.

While solar economics are attractive for California homeowners, the large utilities are arguing that the current program is resulting in a $3bn annual cost shift to non-participants (ie tenants). In fact, 60-70% of minorities do not own a home in California while having to carry a larger portion of grid costs and solar incentives. With this in focus, we counted 145 mentions related to “energy equality” in this latest proposal, 3-5X more mentions than similar unsuccessful proposals over the last several years.

Near Term Upside Potential…

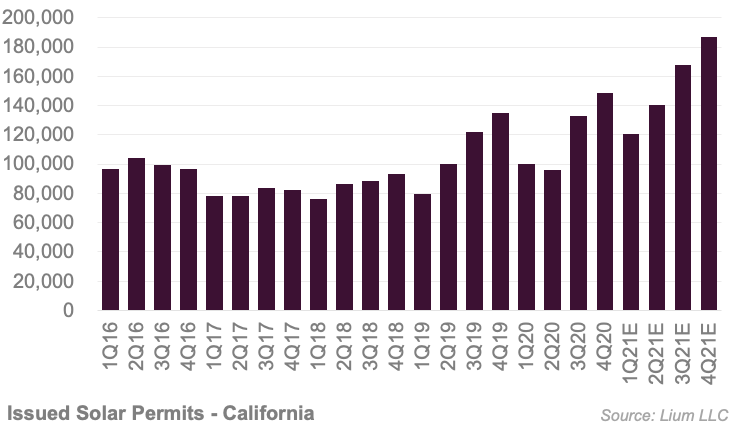

Regardless of the outcome, it is likely that California solar permit / installations will now be higher near-term as installers will encourage potential customers to act quickly and lock in today’s consumer-friendly net metering plans ahead of potential change. The more traction the utilities’ plan gains in the public conversation, the more powerful this incentive (and resulting permitting surge) could be. Before the proposal, we were anticipating California solar permits to increase by 16% / 20% sequentially in Q2’21 / Q3’21 (up 25%-45% y/y).

…Followed By More Risk In The Long Run.

If this proposal is ultimately approved (or even if various parts of it make it through to implementation), it adds net risk to our aggressive California solar growth assumptions and U.S. solar penetration assumptions. If the U.S. is to increase from 3% to 10-15% of homes being solar by 2030 (which most industry participants expect), California will still need to grow at least double digits each year despite already carrying the bulk of the solar load in the last 10 years.

California NEM Catalyst Watch

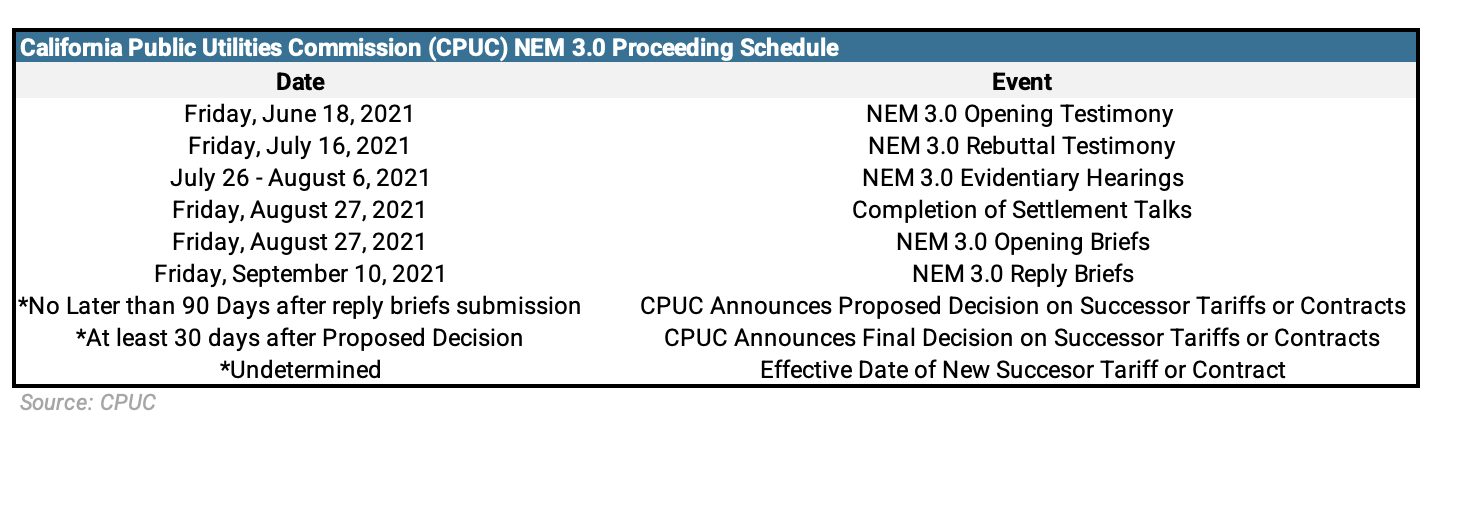

- This latest round in the solar / net metering debate, which began in earnest last week, will continue (and heat up) as solar advocates lobby CPUC with rebuttals and alternative plans until the commission’s final vote expected around year-end 2021.

- While we think the proposal has a higher likelihood of passing than similar utility-backed initiatives in the past (for the reasons described above), these proposals will face an uphill battle in California given CPUC’s prior rejections of utility-backed grid access fees.

- Watch for a near term permit surge. It seems likely that California solar permit / installations will now be higher than average / expected in 2H21 as installers will encourage potential customers to act quickly and lock in today’s consumer-friendly net metering plans ahead of potential change. The more traction the utilities’ plan gains in the public conversation, the more powerful this incentive (and resulting permitting surge) could be.

- If the proposals pass, the new net metering scheme would materially curtail California solar activity as early as 2H21. For perspective, California accounted for 30% of U.S. residential solar installations in 2020.

- CPUC is expected to update its net metering rules with a decision by early-2022, further clarification in 1Q22 and implementation potentially in 2Q22.

- It’s also worth watching if similar proposals pop up in other states.

- As the discussion progresses, we have also included details for upcoming CPUC meetings in this table.

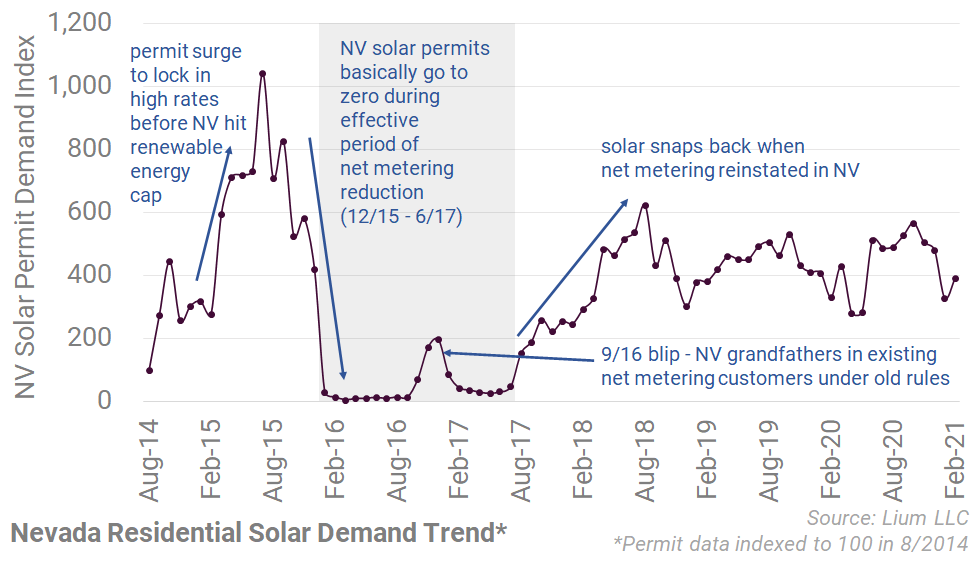

Worst Case Scenario? Nevada Case Study

Nevada enacted a similar solar utility structure in 2015, reducing payments for net metering which caused installations to surge and then drop to near zero until the adverse payment scheme was revoked in 2017. Here is a graph showing what happened in Nevada as a possible “worst case scenario” analog for the California situation.

What Happened

- Last week (mid-March 2021), three large California utilities proposed material changes to CPUC regarding net metering for new solar customers (importantly, existing customers aren’t impacted).

- The changes would reduce residential solar customer benefits by moving to monthly true-ups instead of annual, enacting credit limitations, and adding new tariffs/fees for solar customers.

- The proposals could reduce the economic benefits of installing rooftop solar for many new customers.

- More reading:

- this news article by Rob Nikolewski sums up the proposals pretty well,

- this news article by Edith Hancock adds good debate context, and

- here is the proposal PDF if you really want to get in the weeds.