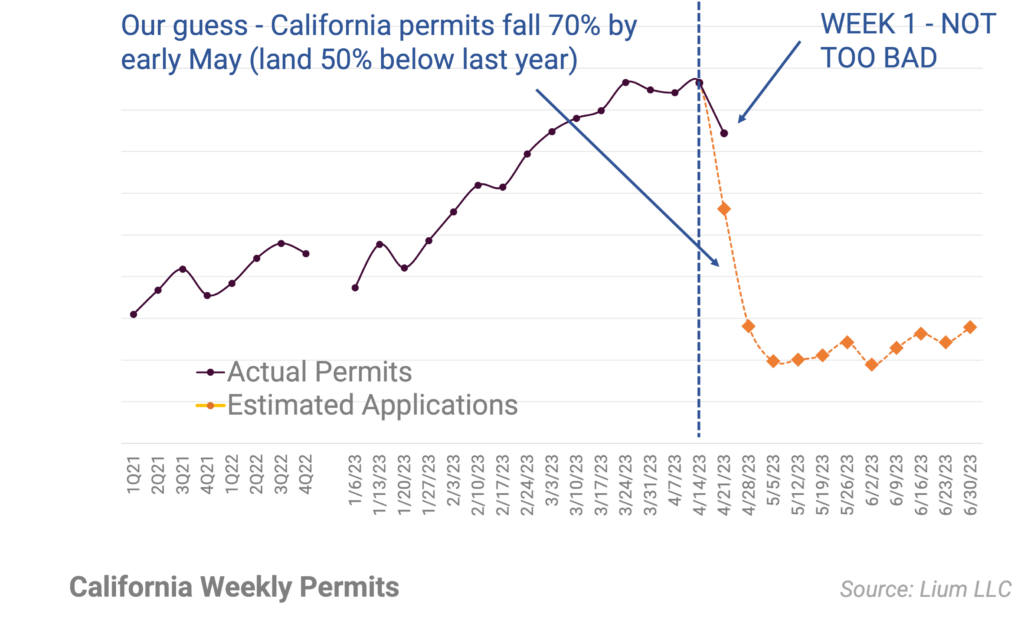

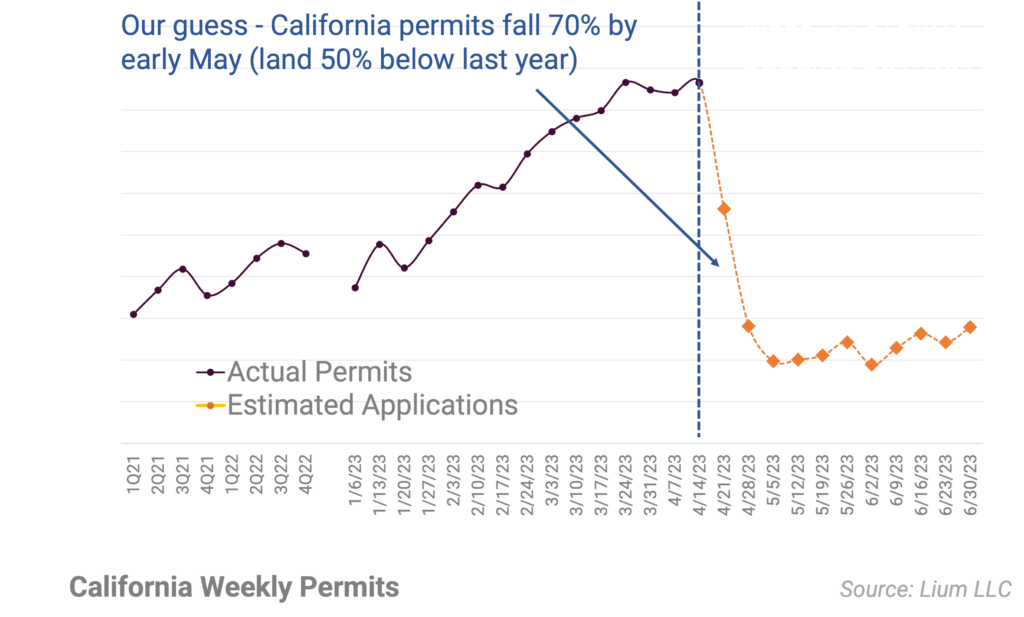

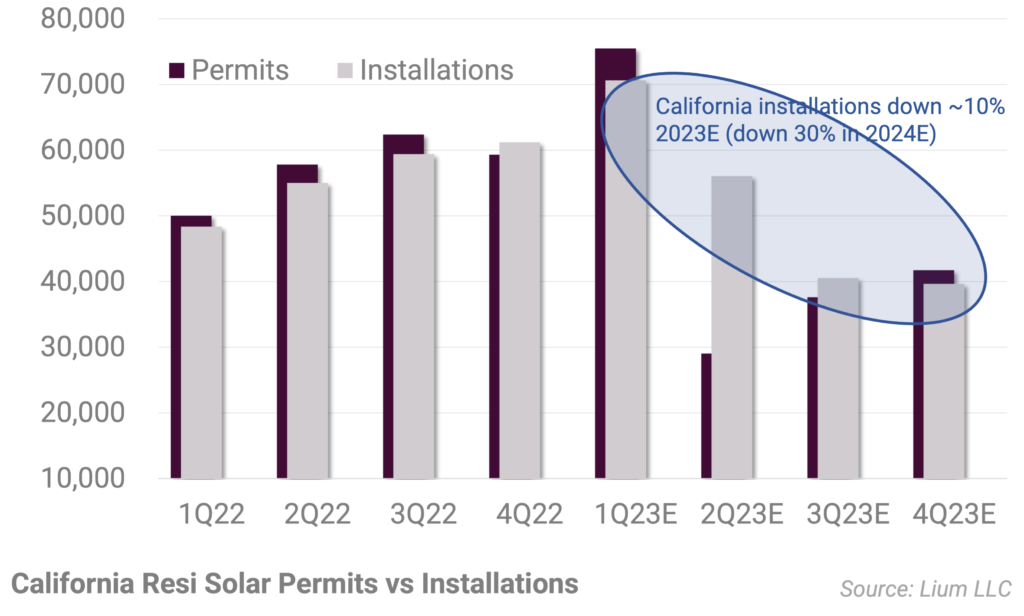

NEM 3 (Week 1) – Not too bad

We think the first week was fairly constructive with permits in the state falling by less than 20% from the prior week

NEM 3 (Week 0) – Five part weekly series tracking the decline in California rooftop permits (SPWR, RUN, ENPH)

Over the last 10 weeks, California permit activity has been a moonshot as homeowners rushed to file paperwork before the NEM 3.0 April 14 deadline.

Takeaways from Austin RE+ Conference

After a strong Q1, leading edge anecdotes at the Austin RE+ conference suggest that new inbounds are coming to a halt in California.

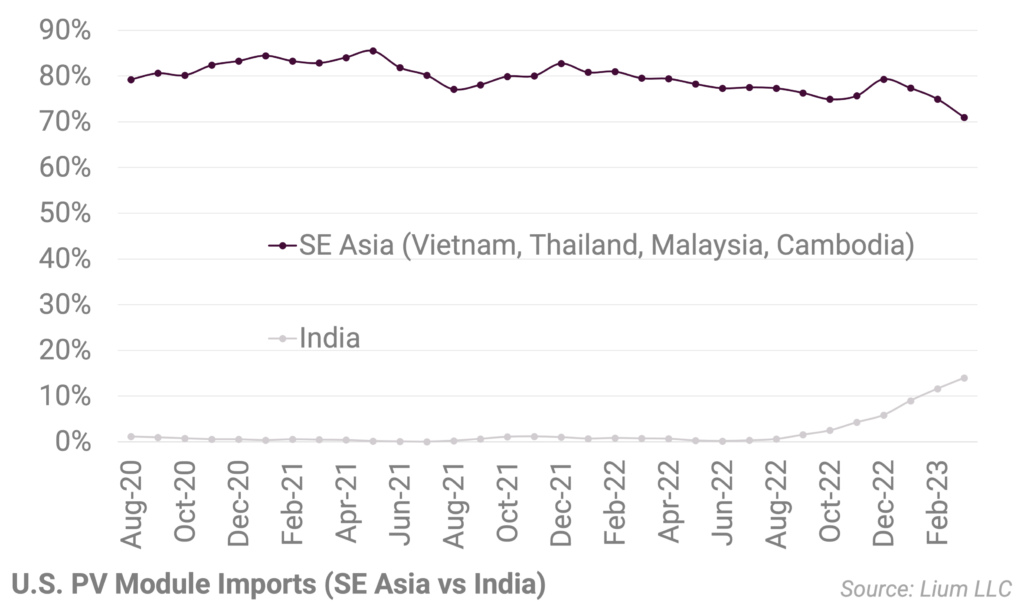

March imports continue to be strong; Cambodia (BYD, New East) big growth; Avoid EIA Monthly Shipments Report (it is wrong)

India, South Korea, and Cambodia imports have been particularly notable, collectively up 400% compared to a year ago.

Updating resi-solar model for California permit surge (Q1 permits +50% y/y)

Since late January, our data is showing a surge (as expected) in California residential solar permits

Feb solar module imports remain firm

Despite noise around detentions, February PV module imports have remained firm.

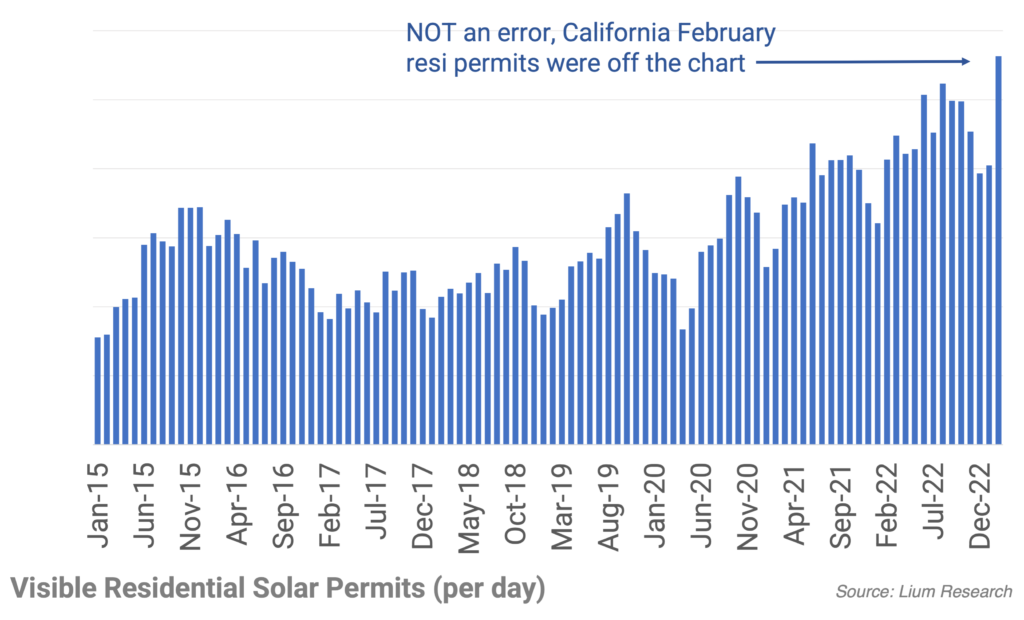

California February permits off the chart

California residential solar permits jumped by 25% sequentially in February and are now up 40% y/y (by far the largest month ever reported – which usually happens in August / September).

Takeaways from Intersolar Conference; U.S. module manufacturing could be 40 GW+; NEM surge underway

We now think that boom could be in the range of 40 GWdc by 2025E, much higher than the 25-30 GWdc that has been announced / in the public domain and only 8 GWdc that exists now.

January import data echos solarSAT views (big jump in module supply)

Recent surge in module availability is putting the U.S. back on track to deliver record solar generation this year

California improved in January (after slow December) – possibly NEM pull forward; Rest of country continues to slow

With California holding up in January, we think Q1’23E could have a shot of only being down single digits sequentially and up ~10% compared to Q1’22.