UTILITY SCALE SOLAR NOTE TO CLIENTS 062625

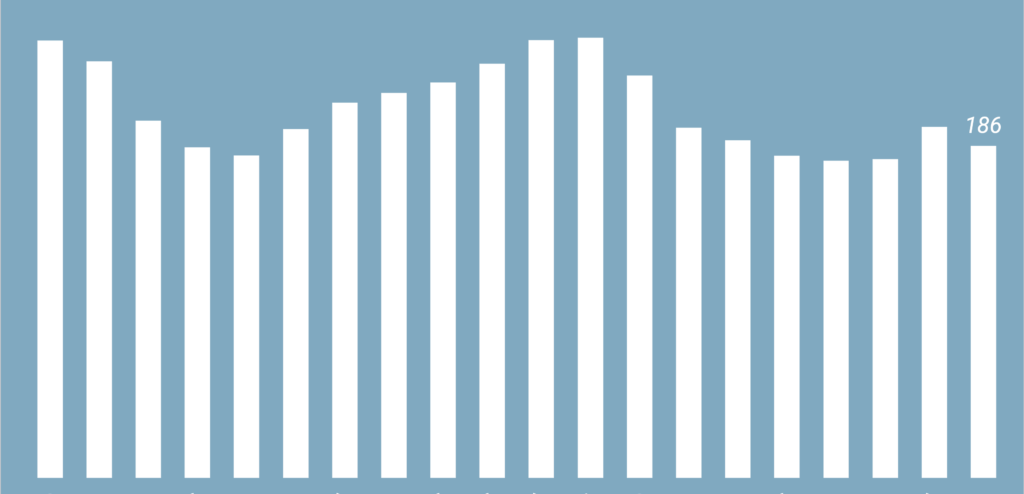

To add transparency to the U.S. utility-scale solar industry, we are now publishing a new monthly Solar Crew Count.

SOLARSAT NOTE TO CLIENTS 061125

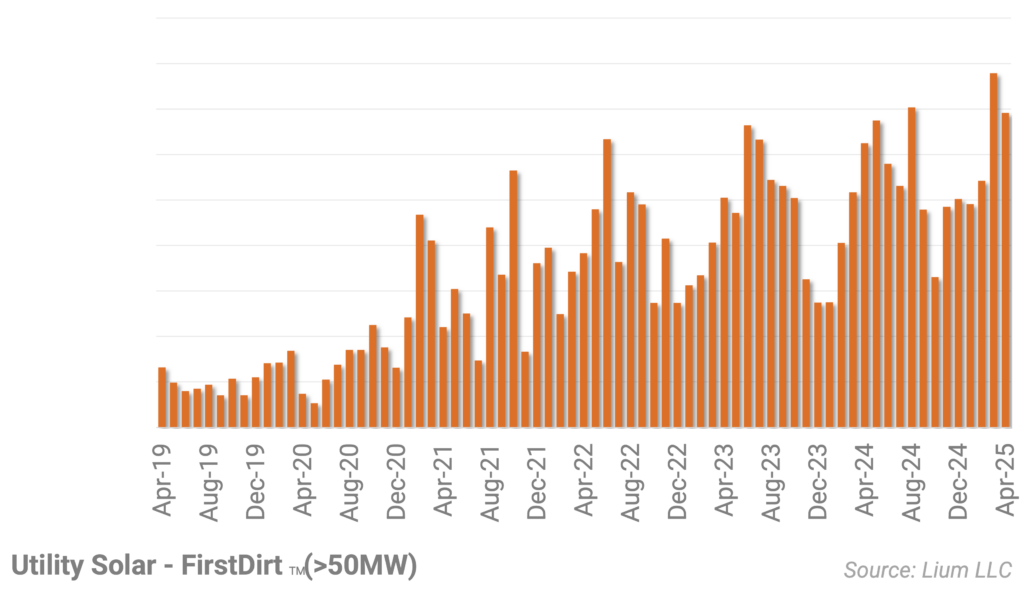

Below see key takeaways after reviewing utility-scale solar construction activity for May 2025.

UTILITY SCALE SOLAR NOTE TO CLIENTS 052225

In this note, we are summarizing the key takeaways after updating our data for the latest development and regulatory filings.

SOLARSAT NOTE TO CLIENTS 051225

Below see key takeaways after reviewing utility-scale solar construction activity for April 2025.

Updating project level details (LS-2) and forecasts (LS-1)

In this note we summarize the changes we have made to our project level details (LS-2) and 2025E / 2026E forecasts (LS-1).

SOLARSAT™: March wraps up very active Q1

Below see key takeaways after going through our utility-scale solar satellite data for the month of March.

SOLARSAT™: Clear inflection (Q1 new starts will jump 20%+ Y/Y); 2025 forecast likely too low

Below see key takeaways after going through our utility-scale solar satellite data for the month of February.

Pipeline firm to start 2025 (another 15 GWac approved); PJM huge driver….others ho-hum

Below we list takeaways after updating our utility scale solar database (LS-2 and PLUS-201).

SOLARSAT™: Construction off to quick start (Jan firstDIRT ~3 GWac)

Below see key takeaways after going through our utility-scale solar satellite data for the month of January.

2025E update; Key themes (Nextera moderating, 12 GWac waiting for trackers, interconnection approvals rebound)

In this note we are updating our LS-1, LS-2, and PLUS-201 data sheets and forecasts.