Momentum continues; Record new construction starts; FLNC+TSLA share gains

In this note we are updating our quarterly large scale battery storage (BESS) data.

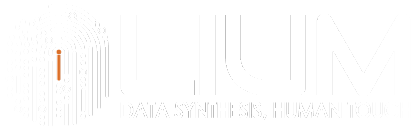

25 developers that will build 70% of capacity; FLNC has 5 of them; AES big jump this year; New developer / integrator matrix

In this note, we break out our battery storage data, highlighting the 25 largest developers that will make up 70% of the utility-scale market in 2024.

Turning our satellites to the battery storage market; firm fundamentals with >12 GW starting this year; watching another 40 GW lining up

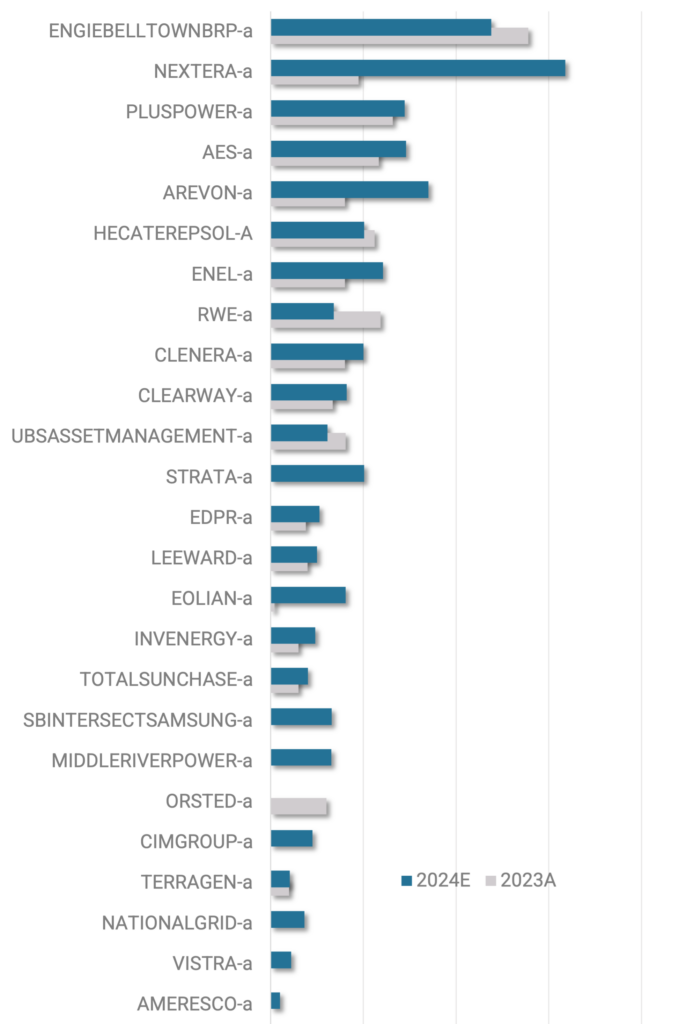

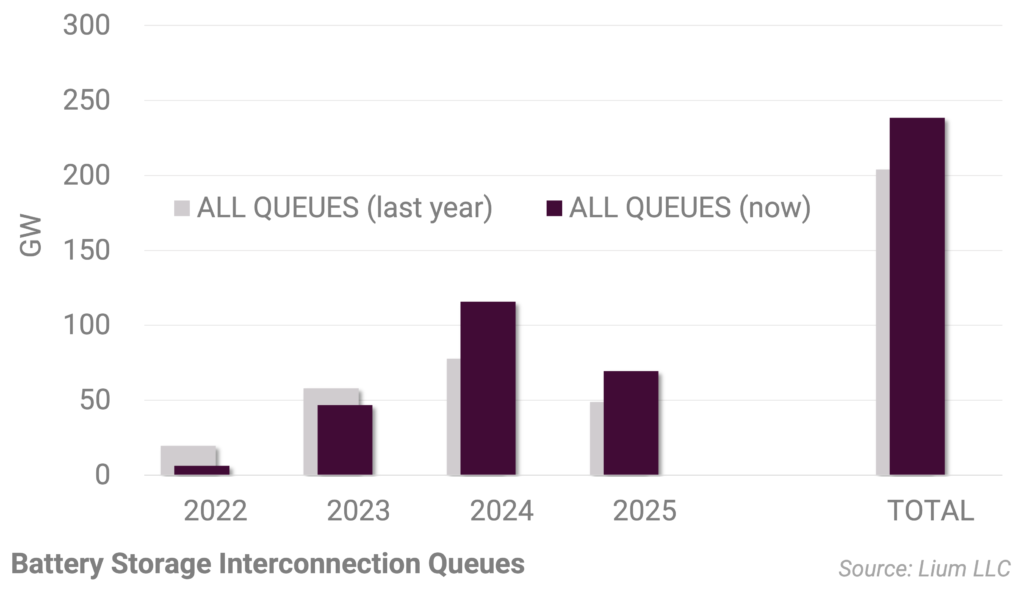

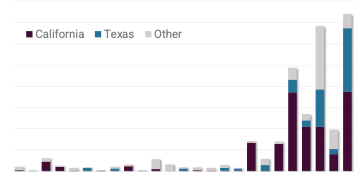

After slow growth in 2022, battery storage interconnections are finally accelerating. In fact, the U.S. is on track to interconnect more than 7 GW in 2023, almost double 2022.

Publishing a new BESS under construction database

Using our construction data as a guide, almost 70% of projects that come online over the next 18 months will likely be collocated.

Publishing BESS project detail by integrator (FLNC, Sungrow, CSI, Powin etc)

we are anticipating the U.S. large scale BESS installations to grow to ~15-20 GW/year by 2025, up from only ~5 GW that was installed in 2022 and 9 GW total installed in the U.S. today.

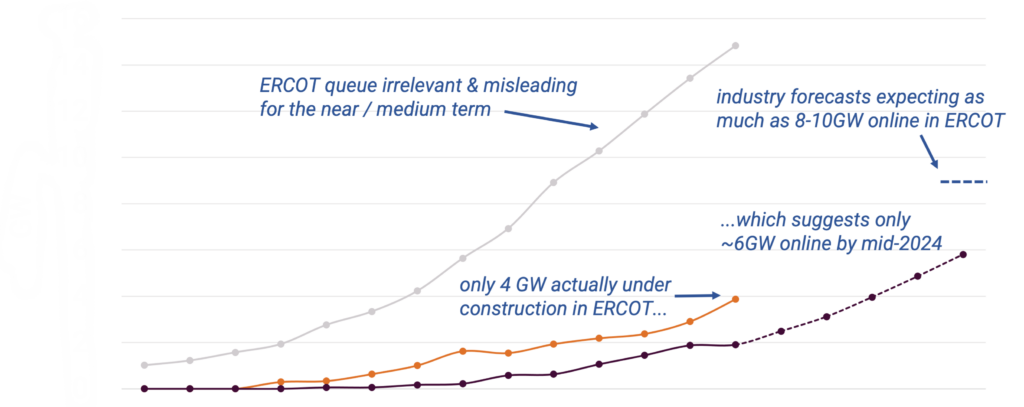

Disappointing 2022 (only 5GW installed vs 7-9GW forecast)… but project pipeline surges again

Disappointing near term installations (driven by supply chain / equipment / labor shortages), with only 5 GW installed in 2022 compared our original forecast of 7-9 GW.

Takeaways From RE+ Anaheim Conference

As an alternative to anecdotes, imperfect surveys, and guesswork, we have created a tool called Lium solarSAT™ to better inform the market with real-time solar satellite monitoring. With this product, investors and corporate management can monitor the status of all U.S. large scale solar projects, including the day each project broke ground (firstDIRT™), timing of panel deliveries, and final completions. In this report, see findings as we update our data for August satellite imagery.

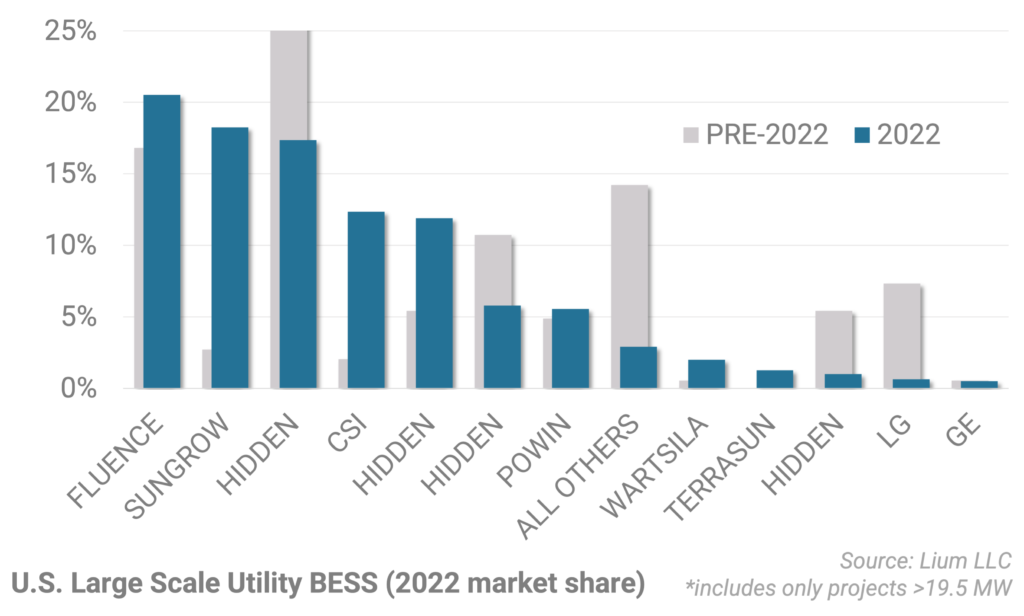

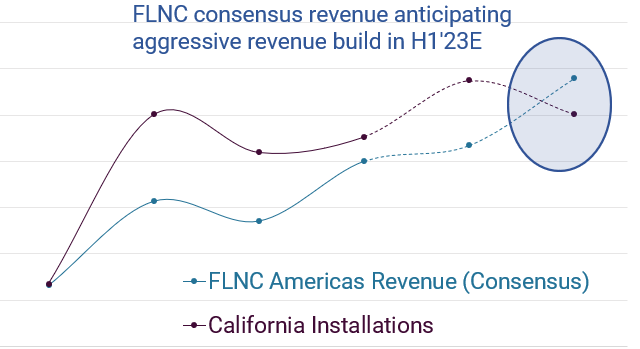

2022 Market share shifts (supplier CATL up again); BESS forecasts UNCHANGED following IRA ; FLNC estimates too high

While costs, solar panel constraints, and stalled policy has been a headwind, deployments of battery storage facilities (BESS) have been surprisingly strong. In fact, a record 1.6 GW of BESS has been connected to the grid in just the last 3-months. This is contrary to the…

BESS deployments hit record in Q2 (1.6 GW); Standalone doesn’t get enough credit; FLNC market share

While costs, solar panel constraints, and stalled policy has been a headwind, deployments of battery storage facilities (BESS) have been surprisingly strong. In fact, a record 1.6 GW of BESS has been connected to the grid in just the last 3-months. This is contrary to the…

Takeaways From Reuters Renewable Finance Dallas Conference

Following two days of immersive discussion at Reuters Renewables Finance & Investment conference in Dallas (where Lium Research was invited to emcee the event and 450 market participants were present), several key themes surfaced and are summarized below.