SOLARSAT™: November new construction slowing for the winter

During November we counted roughly 1.7 GWac of projects that kicked off during the month.

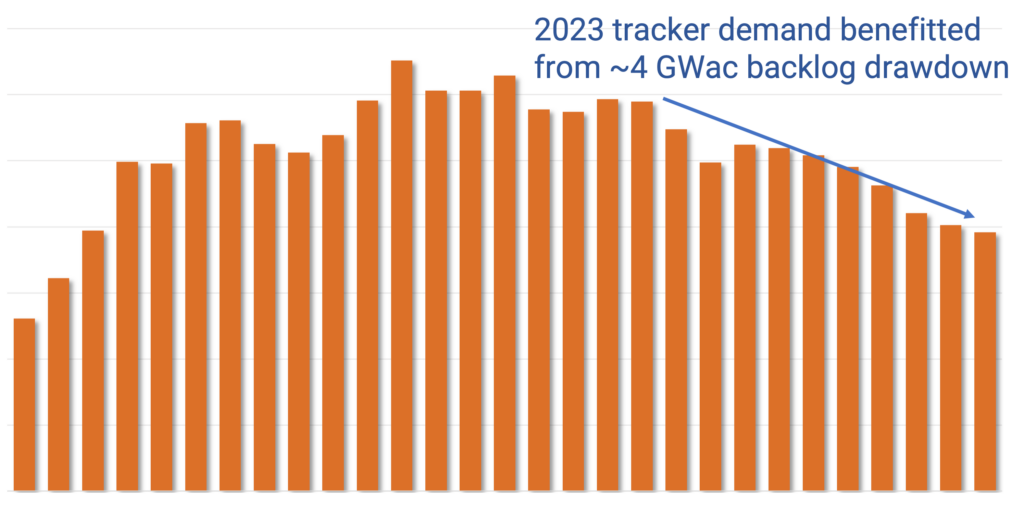

SOLARSAT™: October new construction still firm (up >20% y/y)

One of the constants we have found in utility scale solar development is that ALL projects experience delays

SOLARSAT™: If developers are going to slow down, they haven’t yet (September new construction up 25% y/y)

More than 2 GWac of projects were started in September, down from 3 GWac in June / July, but still up 25% from a year ago.

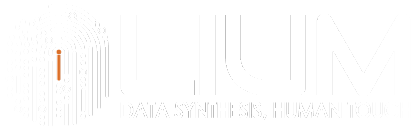

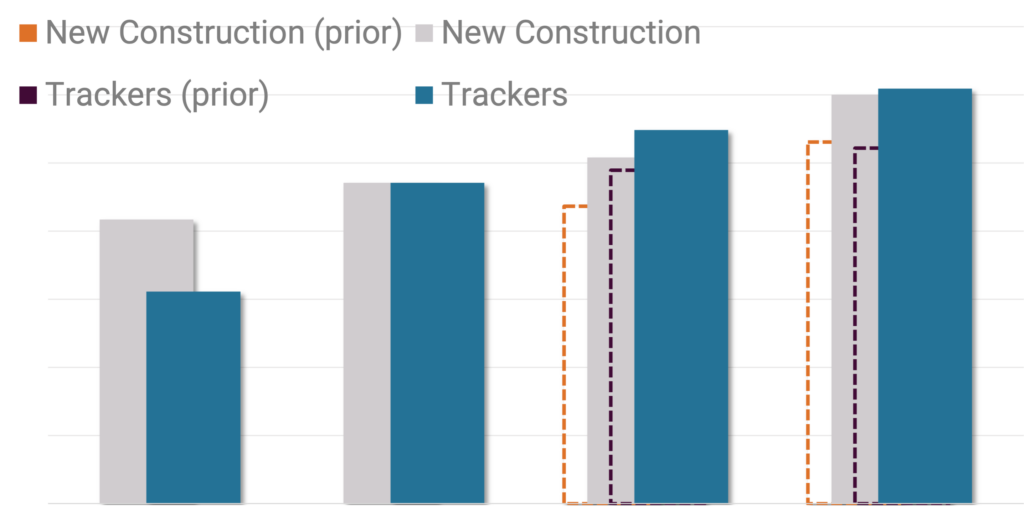

New construction hits 30 GWac 2024E (up 20-25% y/y); tracker demand more modest +10-15% y/y; Orders flat

In this note we are updating our LS-1 Utility Solar Model and LS-2 Solar Database.

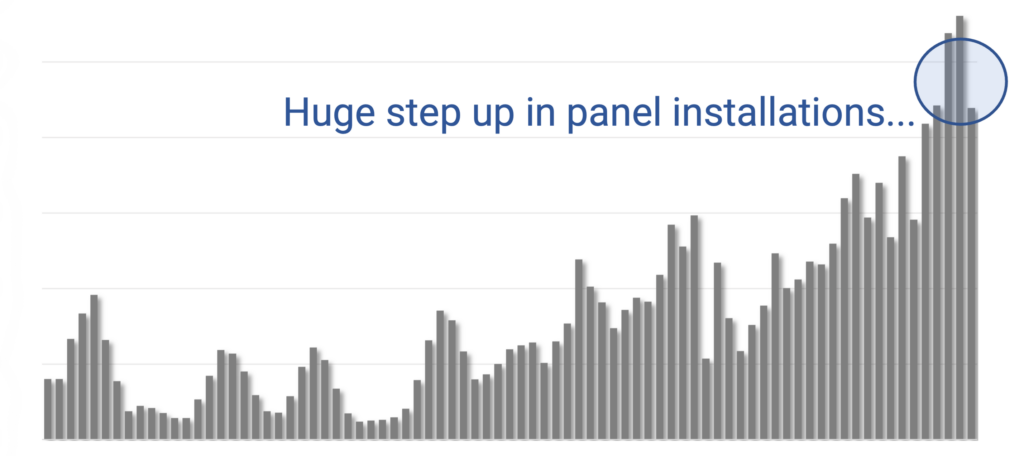

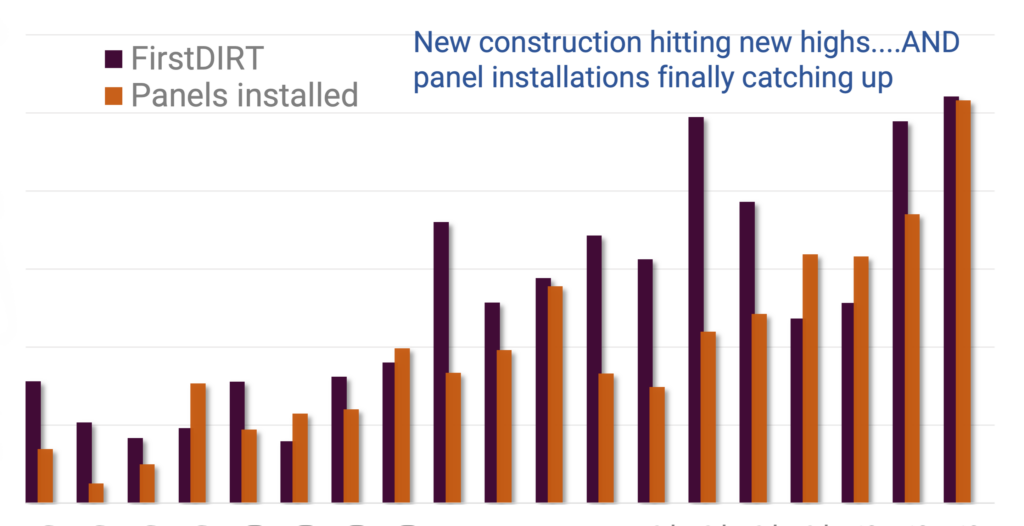

SOLARSAT™: Utility Solar full steam ahead; Q3 tracking +20% y/y; Panel installs up 2x; ARRY slow

Assuming the industry continues to click, the U.S. will soon be installing 30-40 GWac (40-50 GWdc) of utility solar per year

Orderbook study; 95 GWac (~600 projects) getting close to construction; Top 10 developers will make 60% of orders; NXT slight winner

roughly 95 GWac of U.S. projects have recently cleared key regulatory hurdles and are now in late stage project development.

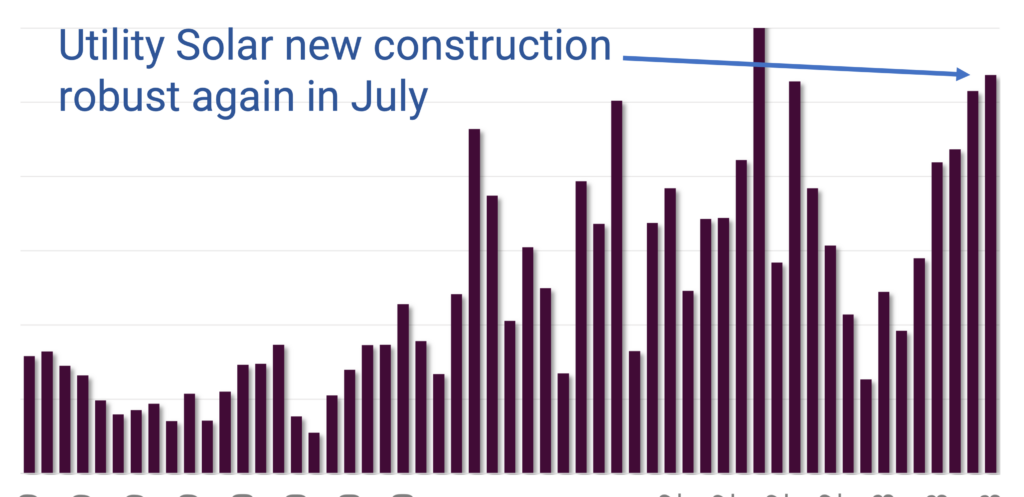

SOLARSAT™: July hitting on all cylinders

Broadly speaking, activity across the board was robust in July, particularly for new construction which was almost double last year.

July slide deck takeaways

Panel supply flows are great compared to 2022

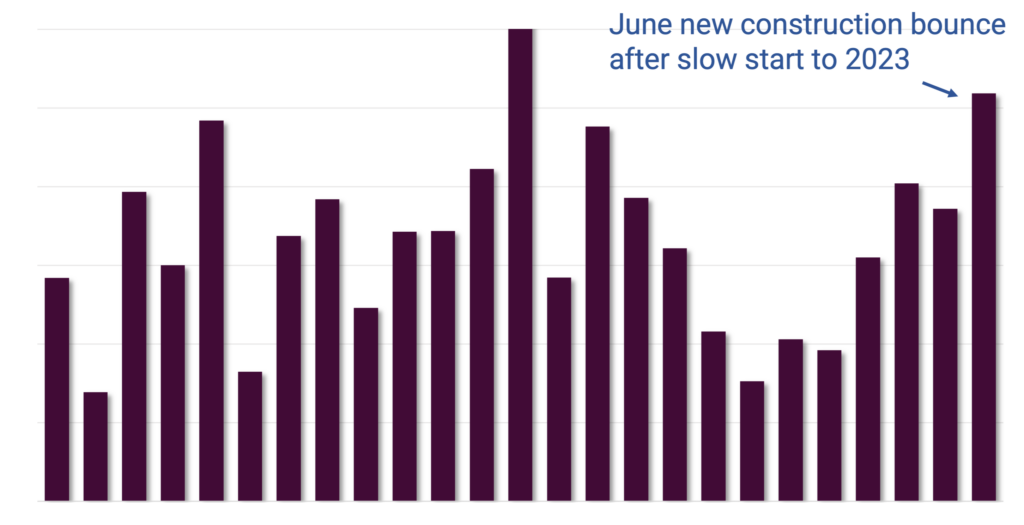

SOLARSAT™: June BIG month for new construction starts

roughly 2.5 GWac (30 GW annually) of new solar was started in June, suggesting that tracker demand can continue to grow despite mediocre new construction in early 2023

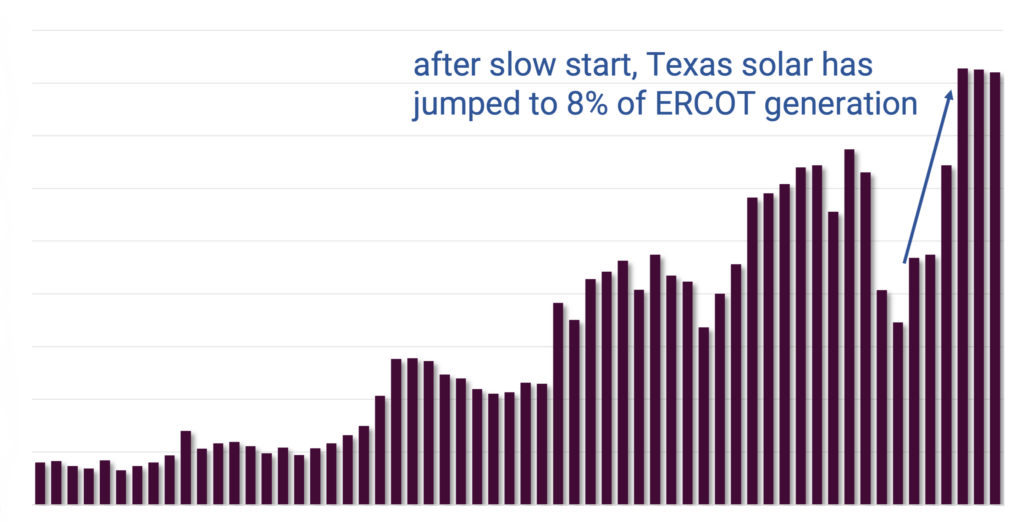

New generation, capacity, utilization data; NXT scores better than ARRY; FSLR on par

Generally speaking, solar generation has been disappointing in H1’23, increasing by a modest 7% (lagging the 20% growth in solar capacity over the same period).