Why It Matters: US offshore wind is a robust renewable energy pipeline at the cusp of implementation. The 2020s will be a decade of value creation, after the prior decade laid the groundwork.

What Happened: This week, our research team was invited to speak about US offshore wind market trends to the clients of a bulge bracket Investment Bank that hosted an Energy Transition investor event. Shortly after our presentation there, we immersed ourselves in industry discussion with sector insiders by attending the Reuters US Offshore Wind 2021 Conference, a large multi-day tradeshow canvassing many market aspects of the US offshore wind buildout. Lium Research was pleased to be a media partner in the event, which was an excellent service to the emerging offshore wind industry – hat tip to the Reuters Renewables Event team for putting on a great conference.

We Came Away With Higher Conviction In 3 Lium Offshore Wind Thesis Points

After absorbing the event’s discussion, our confidence increased in three market calls shared with Lium clients earlier this year:

i) 30GW Is Achievable By 2030. We came away with higher conviction on our April 2021 call that Biden’s 30GW in the water by 2030 goal is achievable. Key themes underscored by the conference panels included unified governmental support across all levels for the sector, open capital markets and good access to capital, mature technology, and progress on derisking multiple links in the industry’s emerging value chain. After a decade of incubation, the challenges and risks are well defined and sector leaders are grabbing the bull by the horns. We were struck by the industry’s strong sense of urgency to move into construction – the time is now – and there is strong alignment between industry and various authorities to push forward to meet offshore wind targets.

ii) Transition From Paper To Steel In The Water. 2021 is an inflection year in the sector’s growth story. We believe this long-cycle, nascent industry is finally at the tipping point of becoming reality, and we think everyone will look back one day at 2021 as the year US offshore wind transitioned into full-bore execution mode after a decade of incubation (January 2021 Launch Report, slide nine).

iii) Catalysts Abound. The conference confirmed that we are monitoring the right categories of market catalysts. In fact, multiple catalysts identified in our February 2021 slide deck were key discussion topics at the event. The potential datapoints in these catalyst categories are a) coming in to focus and b) multiplying.

Three Surprises

There were quite a few insights shared on the conference stage that gave us cause to challenge our own internal assumptions about the industry or think differently about certain market aspects. That’s a sign of a great conference! Here are three examples:

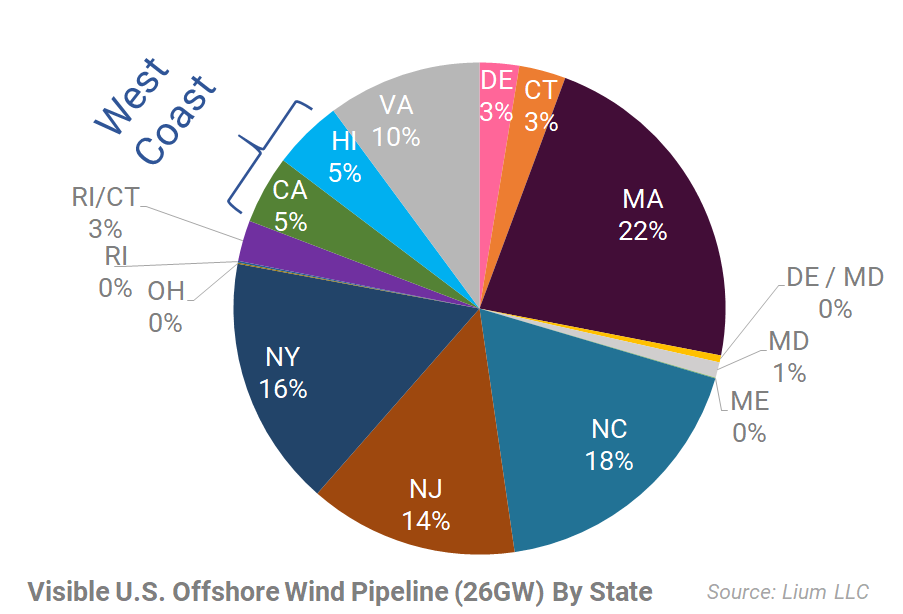

i) Flurry Of West Coast Wind Headlines Are Closer Than You Think. We’ve been bullish on the potential of California offshore wind, but presentations and events this week cause us to think that gigawatt-scale project additions to the orderbook could be coming in from the West Coast faster and larger than some skeptics expect. This observation is underscored by BOEM’s 4.6GW Morro Bay announcement on the first day of the conference – the idea of a lease sale by 2022 had speakers and panelists talking in excited tones. That said, we think this could play out a little like the East Coast has, where we could see a flurry of projects announced / leased / enter the pipeline over the next 2-3 years followed by a quiet period of laying groundwork before steel enters the water. And the projects may be large scale too, as technology progresses – one speaker noted during a panel: “it takes 10x the work to build 10 100MW project, as it takes to build 1 1GW project” (great quote, and a driver for the intensity of project scale!)

ii) Vineyard Wind Timeline. The project’s developer said on stage that financial close will happen this summer with onshore construction beginning near year-end (both about a quarter ahead of our expectations). However, it was also mentioned that COD is a mid-2024 event. We’ve been modeling first power by 2023 for this project, but turbine installation is now expected to begin towards the end of 2023. Lium note: delay risk for the first couple of groundbreaking large-scale wind project in US waters is higher than delay risk for the projects that follow. Lesson learns and supply chain buildout will reduce complexity in projects coming online from 2025-2030. As a result of better clarity on Vineyard timeline, we have updated our COD assumptions for multiple projects in our bottoms-up US offshore wind orderbook (see this companion piece for a summary and link to download the data).

iii) The Magnitude Of The Transmission Challenge. Landing power on the dry side of offshore wind (transmission, grid, and interconnection infrastructure) is a key bottleneck risk that we’ve voiced concerns about recently. That said, the conference helped put a frame around the magnitude of the issue. It’s large. It’s one thing to get turbines in the water, and it’s a whole another thing to get that power where it needs to be. This is a complex issue that involves many stakeholders and cost burden distribution that could delay power generation. Solving the complex puzzle of landing power, integrating wind into the grid, and matching gen to load gives the supply chain buildout a run for its money as the top risk for delays in executing US offshore wind projects. Investors may be more likely to focus on the lack of Jones Act installation vessels than transmission risk, but transmission risk looms just as large. Downstream developmental progress will be key to monitor as the East Coast project pipeline advances towards deployment over the next 12-36 months. Read more about this in part two of our conference coverage…