ENPH volumes up, but broader market still languishing

We are revising down our 2024E projection to -25%, the first notable revision since we published -18% in September 2023.

Updating Q2 model / database (2024E unchanged); Tracker backlog @ 9 GWac; Texas grid 10% solar this summer

In this note, we are updating our utility solar database and pipeline.

SOLARSAT™: Record Q2 new construction starts (9.3 GWac); Top 30 finally ramping; Tracker installs flat y/y

During the month, another 16 projects have kicked off, shrugging off potential AD/CVD tariffs and contrary to the solar construction delay narrative.

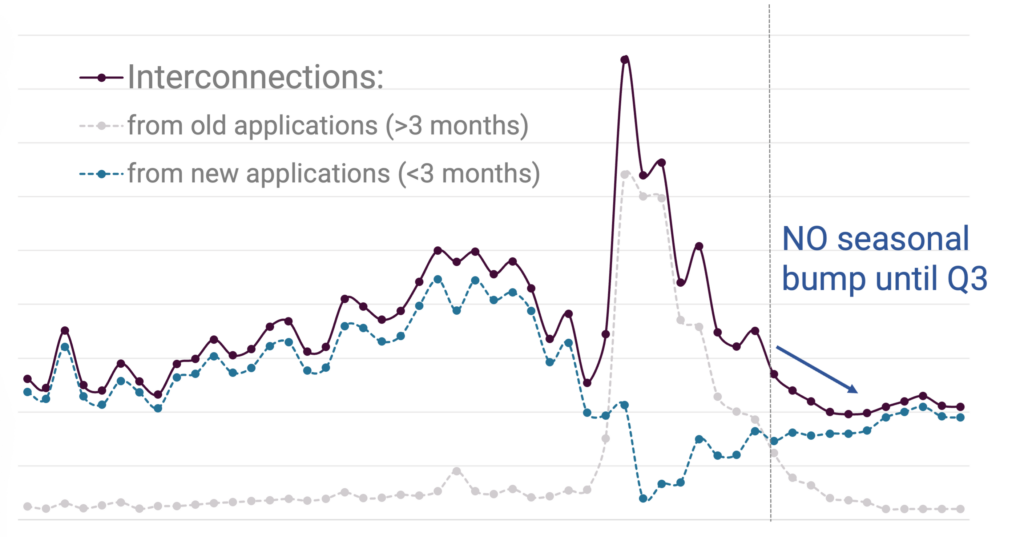

Expected rebound NOT materializing; May permits still down 35% y/y (Cali down 60%)

The much anticipated rebound in residential solar activity is not yet happening, according to our recent permit data.

SOLARSAT™: Another 18 big projects (3 GWac) kicked off in May; Trackers on pace for flattish y/y; SEIA estimates way too low

Despite SEIA claims of a slowdown, persistent delay anecdotes, and tariff fears, actual new solar construction has remained firm.

Pipeline update – new approvals down again; Late stage queue flat at 112 GWac

In this note, we are updating our utility solar database and pipeline.

SOLARSAT™: New construction – no problem; Nextera overweight; Trackers flat; Shoals losing share

U.S. utility-scale solar market is having no problem starting projects.

AD/CVD pockets of risk, but mostly exaggerated

In this note, we summarize our recent data collected surrounding U.S. solar module imports and solar demand as it relates to AD/CVD risk.

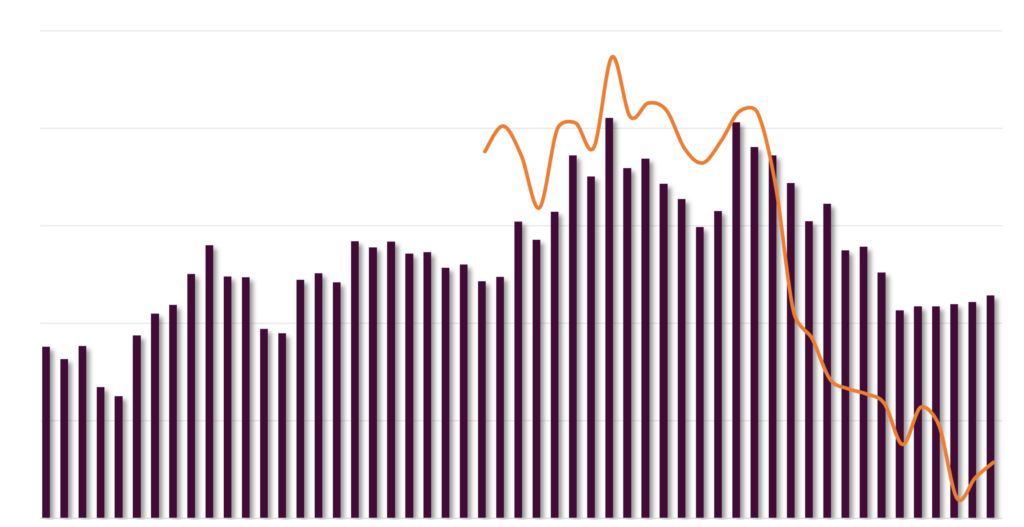

Heads up on 20% decline for Q1 installations (and muted bounce for Q2)

While leading edge indicators have picked up (or at least hit bottom), installations have not and continue to move significantly lower.

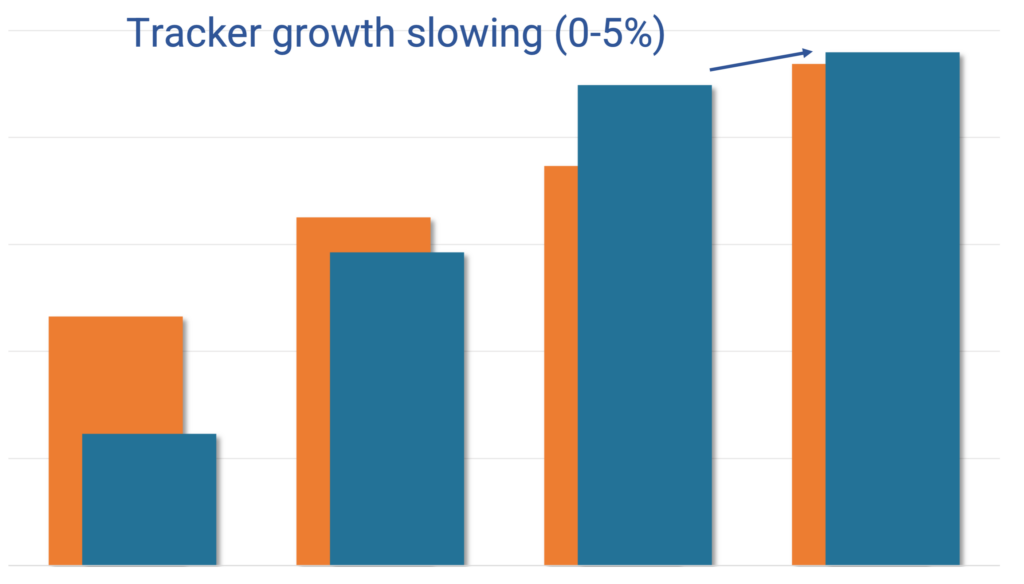

Lowering 2024E tracker forecast (now +0-5%); New construction starts on schedule

After seeing the pace of 1Q starts, collecting new permits / interconnections agreements, and reassessing our developer forecast, we are maintaining our new construction forecast at 15-20% in 2024E.